ALGIERS, Algeria, May 20. Despite the development of the industry and milestones reached over the past decade, the Islamic finance industry globally is still facing certain challenges, reads the joint report of the Eurasian Development Bank, the Islamic Bank Institute and the London Stock Exchange Group.

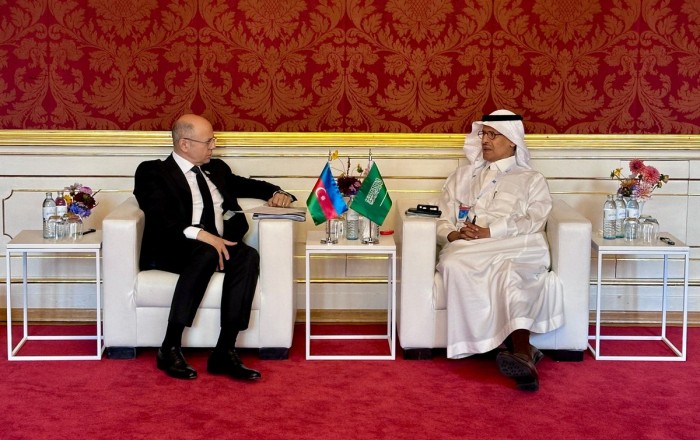

It was presented during the IsDB annual meetings in Algiers, Trend’s special correspondent reports

The authors of the report note that the first challenge is related to considerably higher cost of transactions.

“This requires a solid solution, particularly in the area of home financing, which is ubiquitous in many Muslim countries and also for Muslim communities living in non-Muslim countries,” the report says.

The second issue is about limited options of risk management instruments, mitigation techniques, and quantitative measurement models.

“Despite numerous efforts by the Islamic Financial Services Board (IFSB) in issuing guidelines pertaining to risk management, stress testing, and capital adequacy standards, more detailed technical guidance which features the techniques and methodologies of risk assessment, taking into account unique risks in Islamic financial institutions (IFIs), is still required,” the authors believe.

A restricted legal and regulatory framework is named as another hurdle. “There is a dire need to develop a proper legal environment and suitable regulatory framework to encourage sound risk management for IFIs. In addition, limited liquidity instruments for Islamic capital markets are another challenge,” says the report.

Finally, the authors note the lack of Islamic monetary policies.

“At the macro level, the availability of Islamic monetary instruments is indispensable to support the macroeconomic objectives of the Islamic financial system. Another important element of such an instrument is liquidity management. More efforts need to be undertaken to also allow inter-jurisdictional transactions and liquidity management between the countries implementing an interest-free financial system,” reads the report.

Source: en.trend.az